Responding to the COVID-19 crisis, we have approved the establishment of Disaster Relief Accounts. Contributions to designated Disaster Relief Accounts qualify as charitable donations, tax-deductible to the donor and tax-free to the recipient. Participating organizations can customize a disaster fund to meet the needs of their specific community and direct funds to approved individuals and their defined community impacted by COVID 19.

The Givinga Foundation Disaster Relief Accounts are established in accordance with Internal Revenue Code section 139, which provides that qualified disaster relief payments from any source, including employers, reimbursing or paying individuals’ specified expenses in connection with qualified disasters are not taxable as income and are not subject to employment taxes or withholding.

We’re here to help you.

Contact us to customize an Account

Customize your Account to your company or individual needs

We can work with your organization to customize a Disaster Relief Account based on defined organization goals, needs and objectives. Upon receiving an account, participants can direct funds to designated individuals and community causes. Qualifying individuals can include current and former employees, their families and local community business partners.

Who can Account proceeds support?

Specific Employees or individuals impacted

Local community and small businesses

Designated Non-Profit Organizations

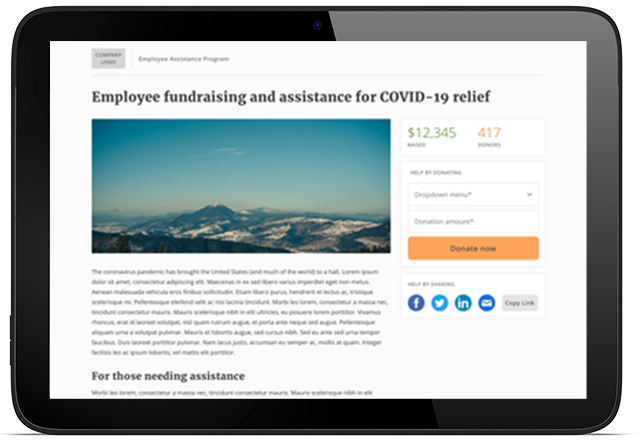

Our technology partner Givinga has enhanced their existing corporate giving and grant management platform functionality to provide companies, their employees and extended community the tools and technology to support their accounts. Givinga’s Disaster Relief Platform is a customizable platform used to create, contribute, manage, distribute and track Disaster Relief Account donations.

Information on additional Q & A’s can be found here. We invite you to connect with us to learn more about how Disaster Relief Accounts can help your company and your community. Click here for more information

Frequently Asked Questions

What are the Required Guidelines and Rules Determining Recipient Payouts?

Qualified disaster relief payments include payments for the following expenses:

- Reasonable and necessary personal, family, living, or funeral expenses incurred as a result of a qualified disaster

- Reasonable and necessary expenses incurred for the repair or rehabilitation of a personal residence due to a qualified disaster (a personal residence can be a rented residence or one you own)

- Reasonable and necessary expenses incurred for the repair or replacement of the contents of a personal residence due to a qualified declared disaster.

Qualified disaster relief payments do not include:

- Payments for expenses otherwise paid for by insurance or other reimbursements

- Income replacement payments, such as payments of lost wages, lost business income, or unemployment compensation.

Can the Fund Support an Individual Internationally?

Yes. There are no implications to the donating organization supporting international recipients. It is recommended companies verify recipient country tax laws to ensure there are no implications or required filings by the recipient.

Does the Fund Recipient Need to be a Current of Former Employee?

No. Employment is not a relevant factor in the selection process, or in the amount or type provided.

What Review Process is Required by the Company to Approve Requests?

Every company may have specific guidelines geared toward their plan; however, all companies must have a person or committee granting final approval that comprised of one of the following:

- Persons who have no financial interest in the company

- Employees who represent a broad range of employees not limited to executives. Employees understand they are acting as “agents” of the relief fund and not representatives of the employer